Was There a Shift in the Storyline?

The last two months of reports on the macro landscape were mixed. Inflation readings were hotter than expected, while retail sales were weaker than expected. And markets seemed to be in turmoil over the confusion of how the Fed would react. So, investors need to ask if the storyline has changed. We think not. Despite some hotter inflation prints, the trajectory is the same. Inflation is cooling, but that ride down to 2% will take some time and be bumpy.

Strong Job Growth Doesn’t Imply Inflation Fears

The Fed statement didn’t reveal much, so investors had to wait until the press conference to get more nuance. A data-dependent Fed heightens the need for investors to be aware of shifts in thinking, so markets were rightfully preoccupied with Fed Chair Jerome Powell’s answers during the press conference. One takeaway from yesterday afternoon’s Q&A was the Fed’s view that strong hiring is not necessarily a reason to be concerned about inflation. Last year, firms added to payrolls and inflation pressures eased simultaneously.

As long as the level of job openings shrinks and quit rates fall, we should notice a minimal risk that rising wages stoke inflation.

First Cut Will Likely Be June

The stickiness of services inflation will likely push out the first rate cut. Last year, markets priced in several rate cuts starting as early as this month, but a few components of inflation changed those expectations.

We’ve always thought the markets were overly zealous in thinking the Fed would cut six or seven times this year. The Fed communicated three cuts this year and we think that’s a reasonable expectation as further cuts may come in 2025. Historically, the Fed hardly ever does what they say, as dot plots are poor predictors of future Fed policy.

The first rate cut will probably come in June, unless something drastic happens domestically or abroad. Labor markets are stable, consumers keep spending, and geopolitical tensions are managed enough for the Fed to have lingering concerns about price stability.

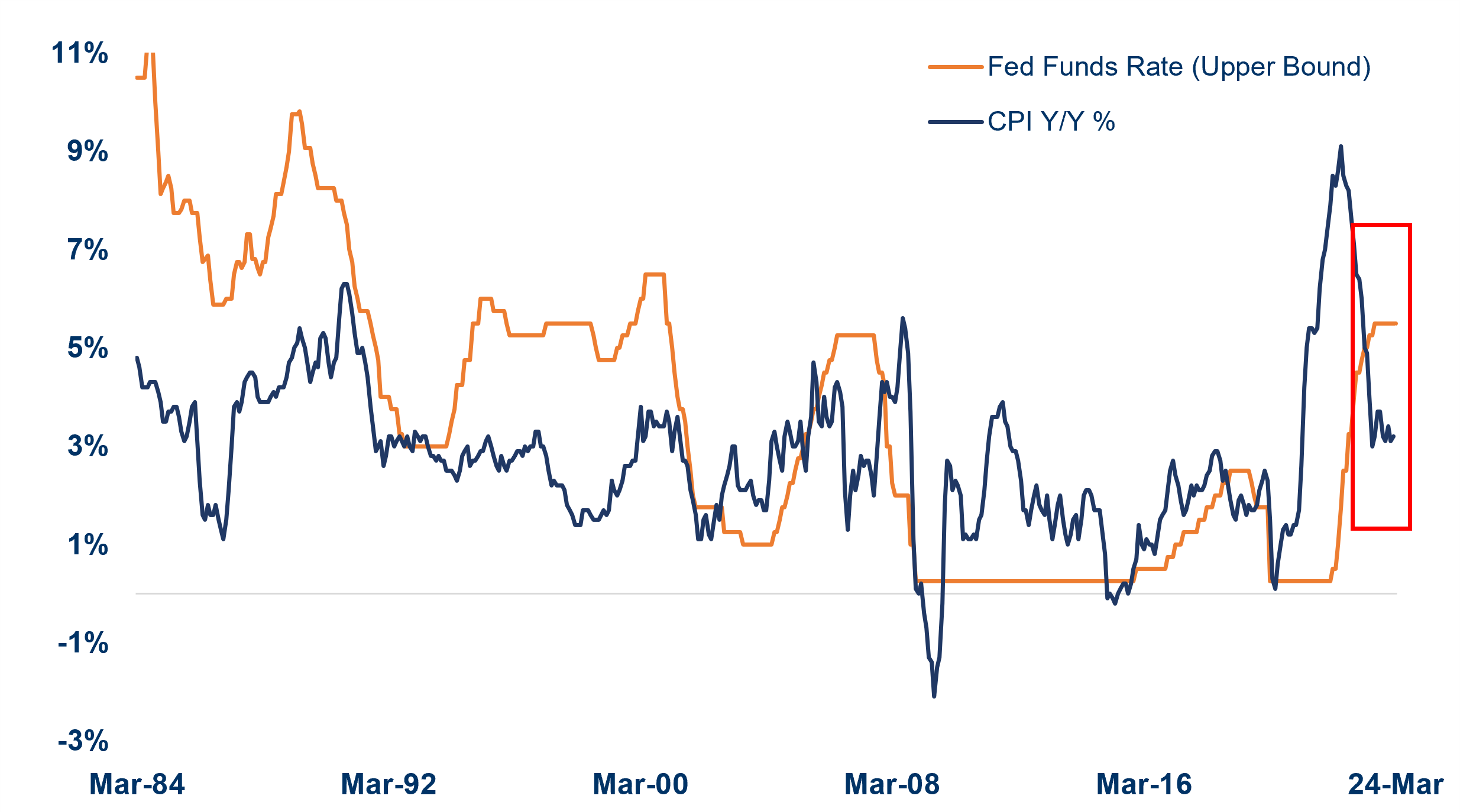

After the Fed’s embarrassing mistake of keeping rates too low for too long and capital markets still reeling from the effects of that mistake, the Fed will not be inclined to make the similar misstep of cutting rates too soon. Despite the widening gap between the nominal fed funds rate and inflation this year, we’ve seen that gap before. However, a gap usually happens during periods of robust business activity. For example, during several quarters of the 90s, the economy grew over 6% annualized and the Fed had to stay hawkish. But this time is not the same.

Fed Funds in Restrictive Territory

FOMC’s Next Move Likely a Cut

Source: LPL Research, Federal Reserve, Bureau of Labor Statistics 03/21/24

Call to Action

The most likely next move for the Fed will be a cut in rates. The real debate is the chronology of those cuts. Despite the delay in the next action by the Fed, investors are still optimistic about holding equities, and so LPL Research recommends staying invested and maintains a neutral tactical stance on equities. We expect some volatility in the near term, but equity markets could experience a positive catalyst as weaker labor costs allow the Fed to launch its next move. Investors should carefully track the U.S. dollar as a leading indicator of investor sentiment during a time where most global markets — except in Japan — expect rates to fall throughout the year.