Following the Fed’s aggressive rate-hiking campaign to combat the massive inflation surge, the stock market will become one where participants are focused on interest rate stability. We expect inflation will come down further, and as it does, interest rate stabilization should help support stock valuations, just as some of the biggest headwinds for corporate America begin to reverse.

ECONOMIC CYCLE

This one has been unique, to put it mildly given the highly uneven recovery in recent years coming out of the pandemic. As previously discussed, a mild, short-lived recession in 2024, followed by recovery later in the year is our basecase scenario. The uncertainty that comes with anticipating a recession may limit stock gains as 2024 begins. But it could bolster investor sentiment midyear, as is typical coming out of an economic trough (the lowest part and turning point of an economic cycle). Keep in mind, the market’s reaction to the economic cycle in 2024 could be muted, given that stocks essentially priced in a recession in 2022 following the surge in growth of the postpandemic economy.

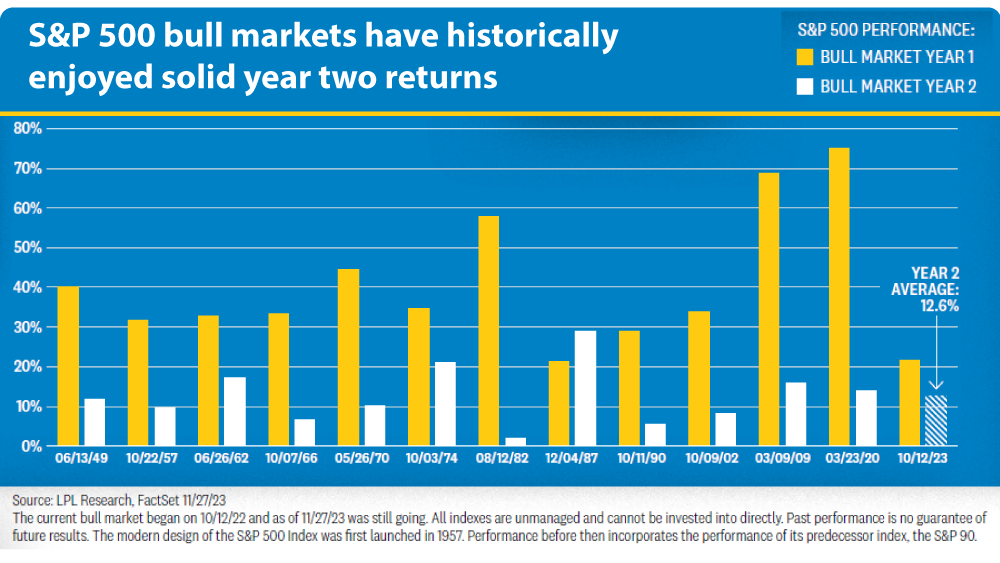

BULL MARKET CYCLE

The young age of this bull market historically points to solid gains ahead. The start of the current bull market (began in Oct 2022) has been unspectacular. Through the first 12 months, the S&P 500 has gained 21.6% (dividends excluded), compared to the historical average of approximately 40% over a similar time frame. The tepid rebound off the market low was partly due to the shallow bear market in 2022 and atypically high valuations at that time that ultimately left less upside in a rebound.

Certainly, sticky inflation and rising interest rates also played roles in slowing this bull, one in which banks. and small caps have underperformed (+1.2% and +4.3% respectively) based on the S&P 500 Banks and Russell 2000 indexes. As the next 12 months of the bull gets underway, market history tells us solid gains may lie ahead. Of the 12 such periods since 1950, the S&P 500 has gained an average of 12.6% and was positive every time. A gain of this magnitude seems reasonable given the potential for support from the Fed as inflation falls.

RATE CYCLE

The current interest rate cycle could be impactful when it comes to stocks. With inflation still elevated, high rates remain a threat to the economy and the stock market. Stocks and bond yields became increasingly negatively correlated (moving in opposite directions) in 2023. While that wasn’t great news for the stock market, it does mean interest rates could present an opportunity, as LPL Research believes the 10-year Treasury yield could be less volatile in 2024.

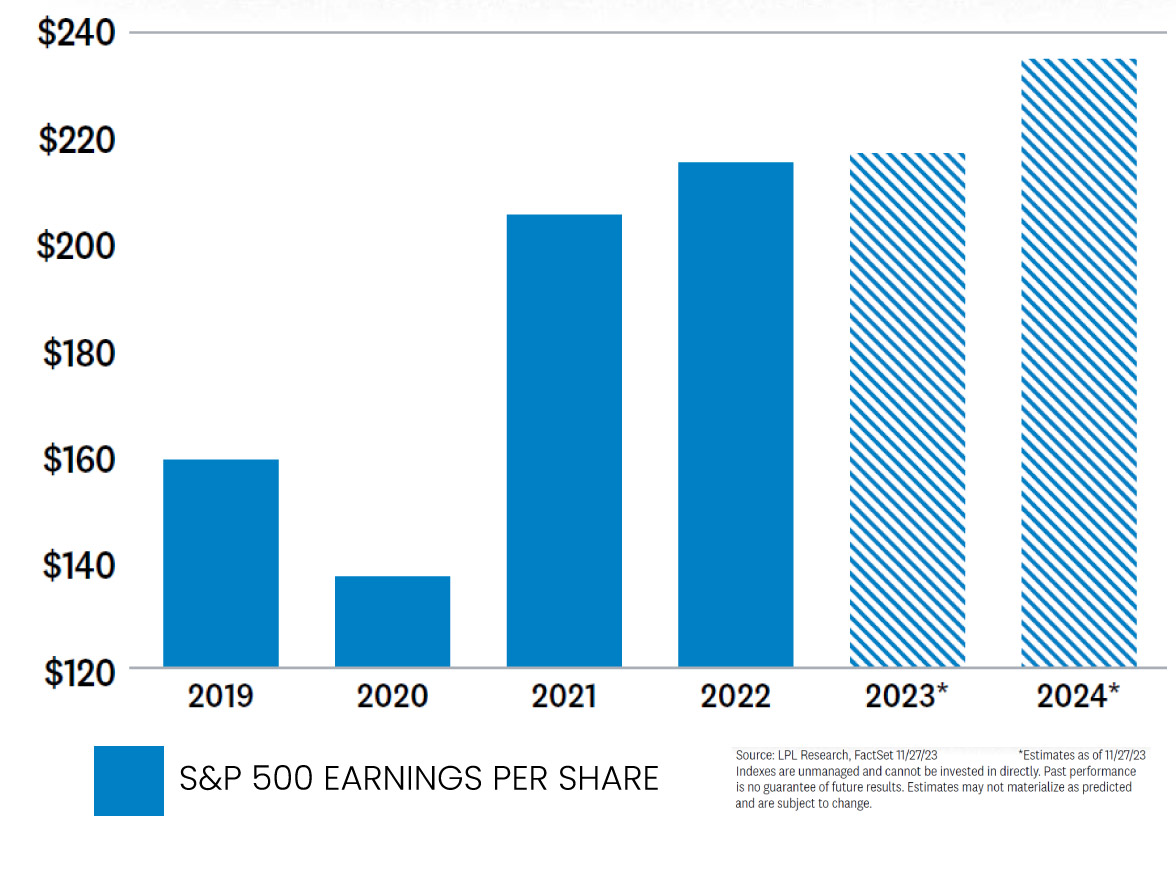

EARNINGS CYCLE

The earnings cycle is entering its sweet spot. With the earnings recession now over, earnings are moving into a period of growth. Analysts underestimated the economy’s resilience and corporate America’s ability to generate revenue and control costs amid intense cost pressures in 2023. Third quarter earnings season continued the favorable trend. Earnings came in 7.7% above estimates on average, while estimates for the subsequent four quarters have held up relatively well, falling just 1.4% during the reporting period.

The bar has been raised for 2024, but if we get only a mild recession as we expect and inflation continues to fall, corporate America should be able to continue its estimate-beating ways. Our 2024 S&P 500 earnings per share (EPS) forecast is $235 per share, up from our prior estimate of $230. The new estimate represents only about 7% earnings growth from the current 2023 consensus S&P 500 EPS estimate of $219. Beyond economic growth, how companies manage waning pricing power as inflation falls is key to the earnings outlook. Reversals of 2023 earnings declines by the healthcare and the natural resource sectors, along with increased earnings growth in the technology sector, will help drive a turnaround in overall earnings.

OVERALL FORECAST

Bearing all this in mind, we anticipate solid but not spectacular stock market returns in 2024. The average return for the stock market over the long term is near 10%, so a gain near average would be good. In 2024, returns may fall less than average. While earnings growth will likely help push stocks higher in 2024, the contribution from valuations may be more limited. Stocks appreciate in value primarily in two ways—either earnings grow, or valuations become richer. The good news is that stocks can move higher in the coming year without much help from valuations—a different story from the past two years.

Stay tuned for more from our 2024 Outlook over the coming weeks. Happy New Year!