Stocks Outlook: Weight of Evidence Points to Modest Gains

Outlook 2023: finding balance conveyed the difficulty equity markets had in 2022 making the transition from a market driven by macroeconomic risks to one focused on business fundamentals. In the first half of 2023, progress was made toward better balance as inflation fell and interest rates stabilized, but macroeconomic risks remain top of mind as a potential recession looms.

History Often Rhymes

We discussed some favorable historical seasonal and cyclical patterns in Outlook 2023. One was the average 10% gain for the S&P 500 in the 12 months following the end of a Fed rate hike cycle. Another was the stock market’s impressive track record following a down year, with an average gain of over 15% the following year, and gains in 15 out of 18 of those years. There are several indicators that help put the current market environment into perspective and suggest additional, but likely modest, gains may lie ahead [Image Below]. One historical precedent that suggests a bumpier ride for stocks is the average performance before the start of a recession. Specifically, the S&P 500 has fallen 1.4% on average during the six months before the start of a recession (since 1970). Of course, no indicator is perfect, but the weight of the evidence seems to point toward modest second half gains, though maybe with some bumps along the way.

Earnings Must Do Their Part

Earnings are likely to decline this year but could still offer some support for stocks given low expectations. Analysts have continued to underestimate corporate America’s ability to generate revenue, which grew 4% in the first quarter of 2023 compared with forecasts below 2%. Higher prices boost revenue and consumers have absorbed higher prices better than many had anticipated. LPL Research sees 4% revenue growth in 2023, even with minimal economic growth, because of the pricing power that has come with inflation.

That solid revenue base won’t help stocks unless profit margins hold up. S&P 500 companies saw an unexpected uptick in margins overall in the first quarter, suggesting additional pressure on margins may be limited. Also consider that margins have contracted about 2 percentage points from their 2021 peak, consistent with an average mild recession. Expect companies to use their efficiency playbooks in the second half to mitigate margin pressures from waning demand and lingering cost pressures.

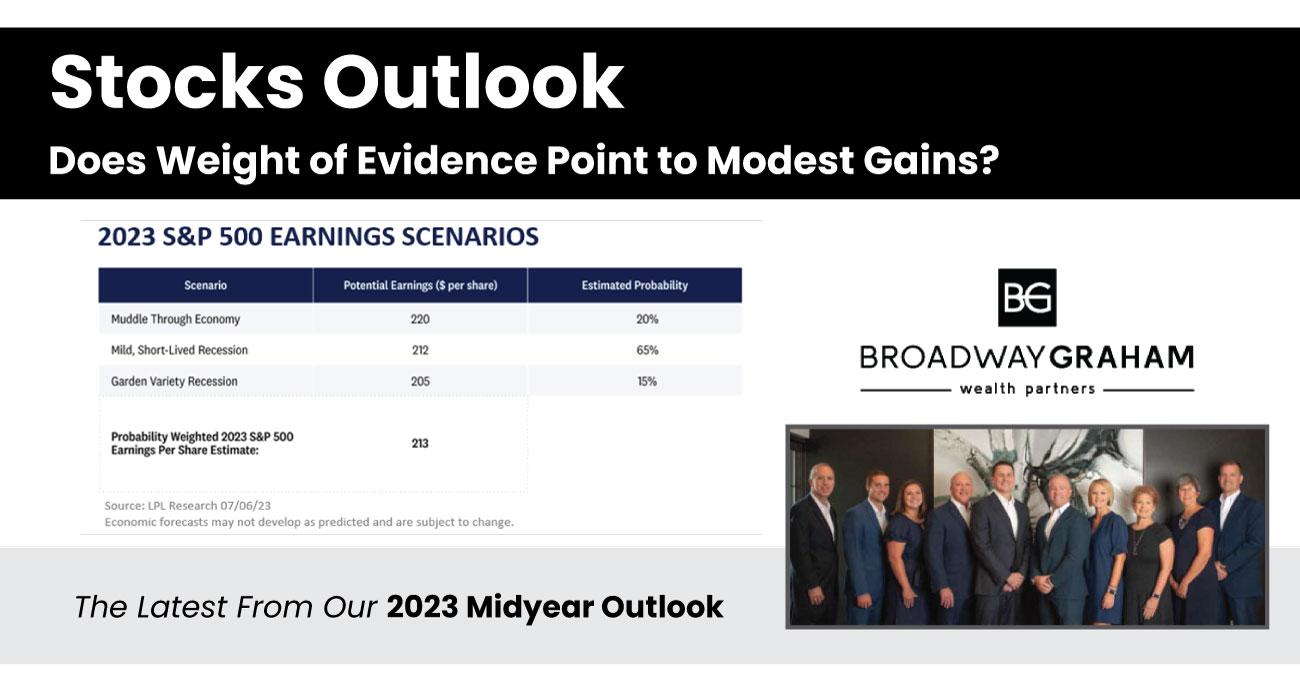

Solid revenue growth and stable profit margins may help limit the magnitude of any earnings decline experienced this year. But given heightened economic uncertainty, we provide three earnings scenarios to arrive at a probability weighted forecast. Based on estimated probabilities of these scenarios [Image Below], we end up with a 2023 S&P 500 earnings per share forecast of $213, about 3% below 2022 levels. At $210, the consensus forecast of equity strategists, compiled by Bloomberg, suggests earnings expectations may be low enough for a modest decline to be well received by markets.

Looking to 2024, corporate America may get off to a slow start as recession potentially spills over. But as inflation continues to come down, helping to ease cost pressures, and economic growth potentially picks up, high-single-digit earnings growth may still be achievable. Our estimated S&P 500 EPS for 2024 is $230, up about 8% from our 2023 estimate.

Perspective On Valuation Depends on The Lens

The valuation debate has reasonable support on both sides. On one hand, the S&P 500 Index is trading at a price-to-earnings ratio (P/E) of about 19. This is above the near-16 average of recent decades, which some say is too high with a recession looming. On the other hand, low long-term interest rates have historically correlated with high valuations, suggesting that a P/E near 19 might be fair with the 10-year Treasury yield below 4%.

Bringing interest rates into the equation allows for a more complete valuation assessment. Fundamentally, a stock’s value is derived from the present value of future cash flows, with an interest rate (also known as the discount rate) in the denominator. Investors also have a choice between stocks and bonds in a traditional asset allocation, so higher yields on fixed income create a higher hurdle for investors to take on equity risk.

The equity risk premium (ERP) for the S&P 500 compares the earnings yield for equities (earnings divided by price) to the yields on bonds (we use the 10-year Treasury) [Image Below]. The current S&P 500 ERP of 0.9% is right in line with the long-term average of 0.9%, suggesting large-cap stocks are fairly valued.

Some Upside Potential but It May Be A Grind

Our year-end S&P 500 fair value target range of 4,300–4,400 is based on a P/E near 19, and our 2024 S&P 500 EPS estimate of $230. Lower interest rates support higher stock valuations, so this valuation looks reasonable to us as long as the 10-year Treasury yield remains range-bound in the mid-to-high 3s. Above our fair value range, investors may want to consider reducing equities exposure. In the event of a correction that leaves stocks close to the 2023 year-to-date lows near 3,800 on the S&P 500, adding equities may be appropriate.

Where We Could Be Wrong

In Outlook 2023: Finding Balance, we outlined bull and bear cases for our forecasts. Now that some of the uncertainty has passed, and year-end is six months closer, we zero in on one base case forecast. At the same time, we acknowledge the possibility of a negative inflation surprise and a hard landing for the U.S. economy, which could potentially bring the October 2022 stock market lows back into play. Geopolitical risks, particularly China-Taiwan, also carry the unfortunate potential to drive a sizable market correction.

Conversely, though not our base case, a faster than expected victory in the battle against inflation, and an economy that muddles through without contracting could power stocks to double-digit gains in the second half.

Equity Asset Allocation Recommendations

Market cap

LPL Research favors large-cap stocks relative to their small and midcap counterparts in the second half of 2023. Large caps generally perform better during periods of economic uncertainty with stronger balance sheets. As 2024 approaches, attractive valuations may bolster small and midcap stocks on optimism about better economic conditions next year.

Style

Lower inflation, stable long-term interest rates, and slow economic growth may help support growth stocks in the second half of the year, aided by support from superior earnings potential. But if cyclical value stocks garner support from increasing economic clarity later this year, buoyed by larger-than-normal valuation discounts compared with growth, growth stocks may struggle to add to strong first half outperformance.

Sectors

Research recommends a balanced mix of cyclical and defensive sectors. Among economically sensitive, or cyclical sectors, our Strategic and Tactical Asset Allocation Committee (STAAC) recommends industrials, which are well positioned for the near-shoring trend and are benefiting from lingering benefits of the post-COVID-19 reopening. Meanwhile, all traditional defensive sectors carry a neutral view.

Real estate, which is a recommended underweight and offers a mix of cyclical and defensive characteristics, faces heightened “work-from-home” risk in commercial real estate. STAAC maintains a cautious view of consumer discretionary as well, due primarily to anticipated increasing pressure on consumer spending in the second half along with elevated valuations.

Region

With the U.S. economy possibly headed for a late-2023 recession, domestic growth may not look any better than growth in Europe or Japan over the next several quarters. Falling inflation, the likely Fed pause, and resilient corporate profits may support attractive domestic equity returns in 2023, but valuations and a potential weaker U.S. dollar, favor developed international equities. The outlook for Japanese equities looks particularly appealing on a relative basis amid continued accommodative monetary policy.

While a weaker dollar could support emerging market equities, which also enjoy attractive valuations, soft earnings and geopolitical uncertainty, particularly in China, keep us largely on the sidelines.